employee stock option tax calculator

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Value of Shares10000 shares 3 30000.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

This calculator has been updated to reflect changes to the tax treatment of employee share scheme ESS interests.

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

. If you are an employee of a non-profit organization calculate how much of your income you should defer through your organizations 403b plan to prepare for retirement. This is calculated as follows. On this page is a non-qualified stock option or NSO calculator.

How much are your stock options worth. Youll either pay short-term or long-term capital gains taxes depending on how long youve held the stock. The Stock Option Plan specifies the total number of shares in the option pool.

Using the ESPP Tax and Return Calculator. 4 HI hospital insurance or Medicare is 145 on all earned income. 40 of the gain or loss is taxed at the short-term capital tax.

When you hold your investment for over a year youll qualify for the. It may surprise you how significant your retirement accumulation may become with regular employer contributions to an Employee Stock Option Plan ESOP. The plan was an incentive stock.

Section 1256 options are always taxed as follows. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the price you paid to exercise the option if both of these are true. Ordinary income tax and capital gains tax.

Taxes for Non-Qualified Stock Options. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Employee share scheme calculator.

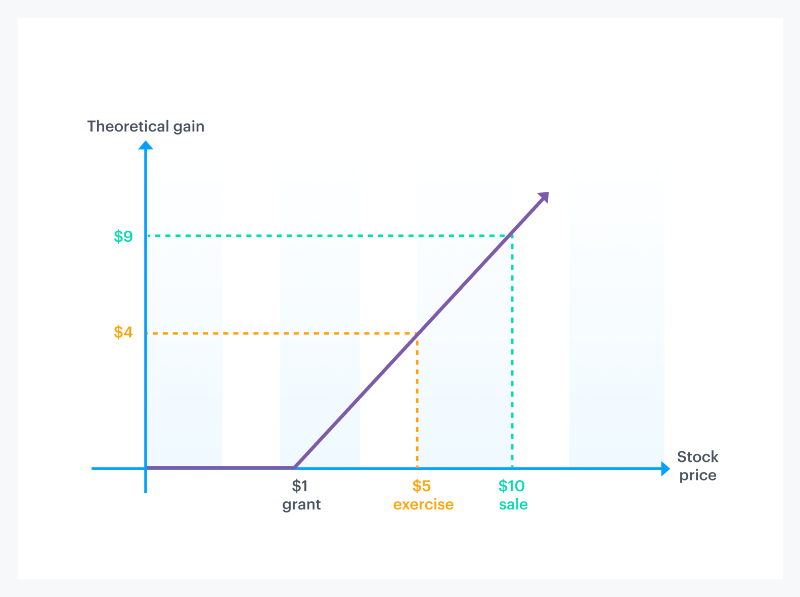

The Stock Option Plan specifies the employees or class of employees eligible to receive options. In our continuing example your theoretical gain is. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

How To Calculate Iso Tax. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. ESOP gain but Zero Risk Strategy.

Employee Stock Option Tax Calculator. Exercising your non-qualified stock options triggers a tax. Build Your Future With a Firm that has 80 Years of Investment Experience.

Get the capital you need to exercise employee stock options from Equitybee. This permalink creates a unique url for this online calculator with your saved information. Taxation at the employees marginal tax rate.

Employee Stock Option Fund. 60 of the gain or loss is taxed at the long-term capital tax rates. These changes took effect on 1 July.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Ad Exercise your employee stock options with no upfront fee. Click to follow the link and save it to your Favorites so.

Employee Stock Option Calculator for Startups Established Companies. Get the capital you need to exercise employee stock options from Equitybee. Your payroll taxes on gains from.

Opry Mills Breakfast Restaurants. There are two primary forms of. The calculator is very useful in evaluating the tax implications of a NSO.

An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount. In the event that you are unable to calculate the gain in a particular exercise scenario you can use the. Lets say you got a grant price of 20 per share but when you exercise your.

The wage base is 142800 in 2021 and 147000 in 2022. There are two types of taxes you need to keep in mind when exercising options. The stocks basis is the total of both.

Stock Option Deduction Stock option benefit as previously calculated 8000 Less. Ad Fidelity Can Provide You With Some of the Best Equity Compensation Strategies. Build Your Future With a Firm that has 80 Years of Investment Experience.

Emily made an Exercised Share Profit of 20000. Cost of Shares10000 shares 1 10000. Restaurants In Matthews Nc That Deliver.

The following calculator enables workers to see what their stock options are likely to be valued at for a range. The ordinary income might be more than the gain on the sale. Ad Fidelity Can Provide You With Some of the Best Equity Compensation Strategies.

Subtract the amount paid for the stock option price. Stock option deduction ie 50 4000 Net Taxable. The strike price of.

An employee stock option is a form of equity compensation that is offered to employees and executives by upper management. Use this calculator to. Ad Exercise your employee stock options with no upfront fee.

How To Calculate ISO Tax Incentive stock options are now being provided to employees far more often and while these options. Use this calculator to help. Your company-issued employee stock options may not be in-the-money today but assuming an investment growth rate may be worth some money in the future.

Getting Esop As Salary Package Know About Esop Taxation

Employee Stock Options Financial Edge

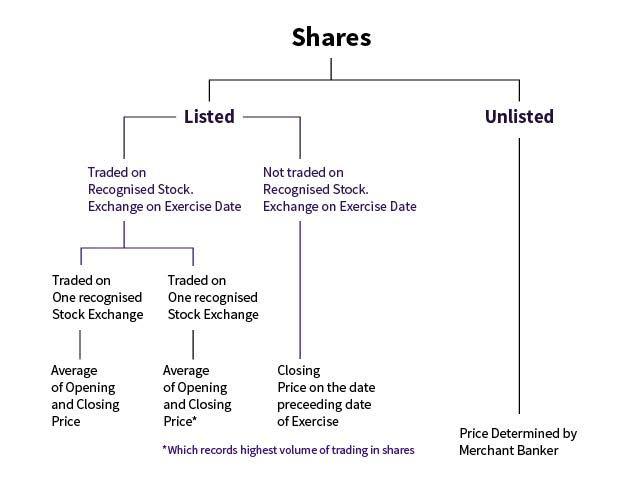

Employee Stock Option Plan For An Unlisted Company

How Much Are My Options Worth Eso Fund

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

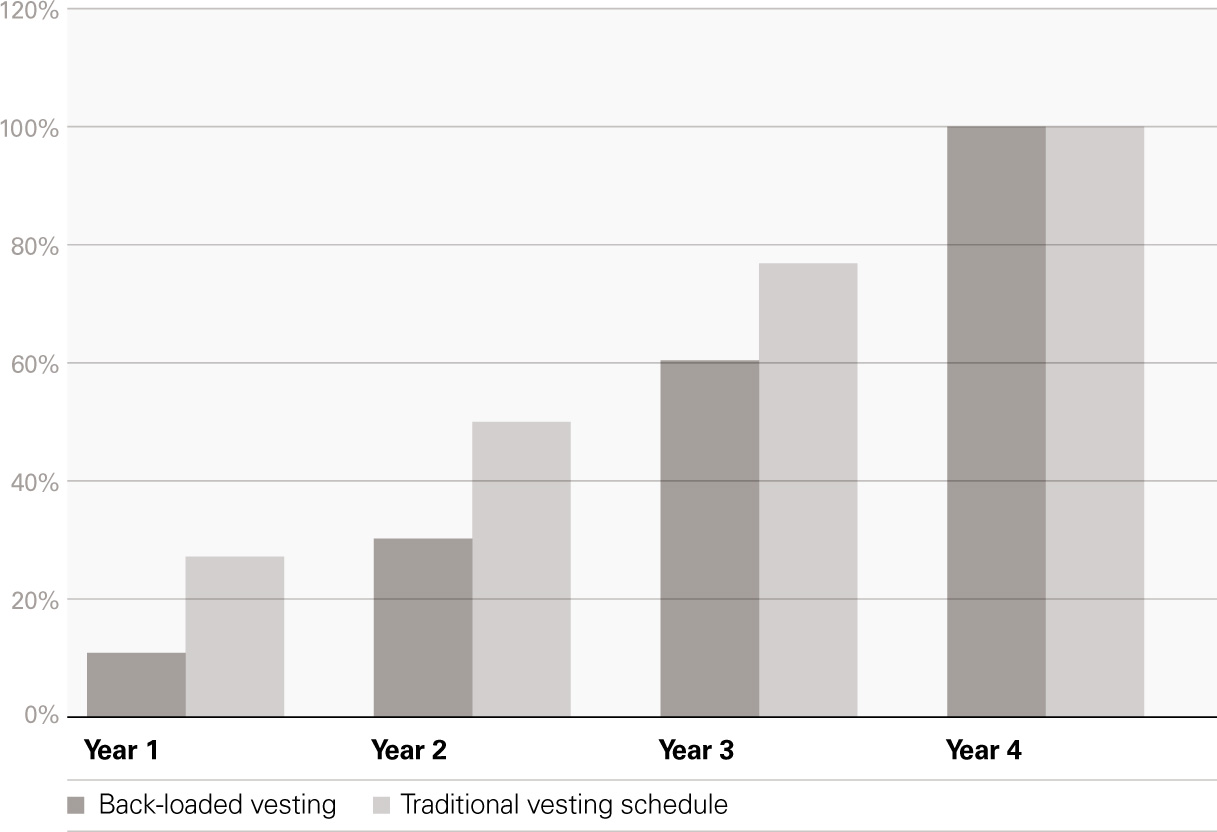

Rewarding Talent Esop Rules Index Ventures

Employee Stock Options Financial Edge

Tax Planning For Stock Options

Stock Options 101 The Essentials Mystockoptions Com

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

How Stock Options Are Taxed Carta

Tips To Make The Most Of Your Esops Businesstoday

How Stock Options Are Taxed Carta

Esops In India Benefits Tips Taxation Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)